A savvy woman has revealed how she is saving £1,500 per month on her household bills using a few simple tricks.

Pernia Rogers grew “fed up” of having no money left at the end of each month.

No matter how hard she tried to budget, she still ended up living paycheque-to-paycheque.

The 30-year-old knew something needed to change and so, switched up her mindset and cutback in areas she wasn’t willing to before.

READ MORE: ‘I’m a British Army soldier reselling clothes online in my spare time to tackle £48,000 debt’

Now, she’s saving just under a whopping £1,500 per month on her household bills.

“I knew that I could do better with my personal finances,” the chartered accountant, who lives in London, told Absolutely Business.

“I owed it to myself and my future to balance enjoying the present with financially planning ahead.

“So I optimised my own spending.”

Here’s Pernia’s top penny-shaving tips – split up into key money-guzzling categories.

PHONE CONTRACTS

It’s easy to get caught up in the whirlwind of new phone models being released each year and thinking that it’s a must-have.

But Pernia, who used to feel the same, changed her thought process to slash her monthly contract from £42 each month, to just £16.

She said: “The main thing to remember is that you don’t have to have the latest iPhone every year.

“I kept my last phone for several years until it literally stopped working.

“Just understand what you really need and stay with what kind of package and phone works for you.

“Use comparison sites to find different quotes.

“And you are allowed to haggle.

“Negotiate with your preferred supplier and get a SIM only deal, rather than a plan with a phone, as these tend to be more expensive in the long term.

“If you really need or want a new phone, then save up to buy it outright instead.

“See what else you can get included, too.

“For example, these contracts often include a package deal to get a certain number of months free with a streaming platform.

“With my contract, I get Disney+ at no cost for six months.”

Pernia also says to look at contracts where the plan includes working abroad, rather than on a usage basis.

Her biggest tip, though? Start your contract in April or May to avoid any sudden price increases that happen each new tax year.

HOUSEHOLD BILLS

Across the UK, the cost of living crisis and constant bill price hikes have left people feeling uneasy about their finances.

But Pernia has a few simple tricks to ensure there’s money left in the pot to enjoy life.

She said: “Where there is no competition, such as with water, the only thing you can control is how you use the commodity.

“For example, switch off power to electronics when not using them – especially overnight.

“Full laundry loads on a lower temperature work wonders, as does letting them hang out to dry.

“Open or close curtains depending on the season and doors, too, to keep heat in and the cold out.

“And take short showers over baths.

“I play a song and give myself the length of it to shower.”

Pernia’s saving roughly £30 each month on her utility bills using these tips alone.

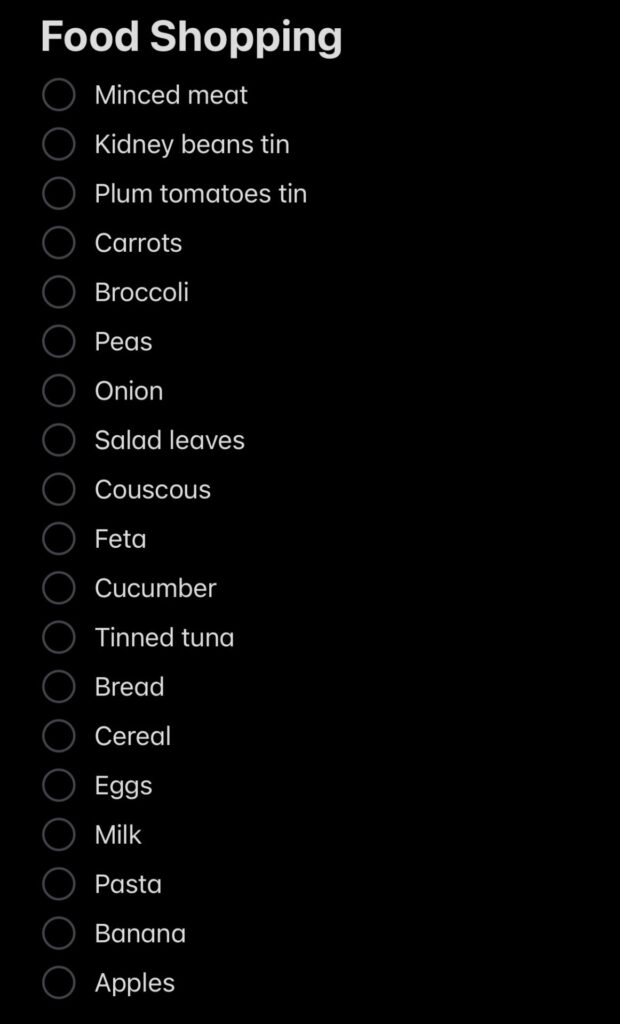

FOOD SHOPPING

The finance expert says that most supermarket layouts are made to make people spend more money than they need to.

It’s important to remain focused and come prepared with a well thought out list.

Pernia said: “It’s the same with supermarket discount and loyalty schemes; it’s all about money making.

“Go shopping with a list that maximises ingredients for the meals you need, which will prevent any distraction.

“Include bulk cooking lunches and dinners.

“Heat these up in the microwave, which is more energy efficient than using the oven and hob, and this will reduce any craving to order takeaways as you’ve just got to simply reheat and eat.

“It also stops going to local shops for treats where the prices are typically higher.

“And utilise bulk buying discounts on non-perishable goods.”

Pernia says she’s saving £20 per week on groceries, over £37.50 by not eating out at lunchtimes and a further £40 per month on not ordering takeaways.

SUBSCRIPTIONS

There’s a subscription for just about anything nowadays.

And many of these services have hiked their prices up – but how can you get more bang for your buck?

Pernia said: “Nobody needs the super expensive top-of-the-range subscription deals.

“If I’m honest, these are the real budget killers.

“I reviewed mine and cancelled the ones I wasn’t using often enough to justify the spend.

“Along with my husband, we optimised these so we only had one or a family plan instead of two individual plans.

“I still get to use Netflix, Apple TV, NOW TV, Paramount Plus, Disney+ and Amazon, for a fraction of the price.”

In total, she’s saving an eye-watering £84.94 per month.

She added: “And don’t be afraid to go for the lower ends deals that have ads included.

“It’s no secret that these platforms use the tactic of releasing series or episodes over a long time period instead of all at once to keep the subscription active.

“Just wait until all the episodes are out, watch them and then cancel.

“And look to rejoin when deals are in place like on Black Friday.”

GYM MEMBERSHIPS

It’s important to keep fit and healthy – but at what cost?

She said: “There’s no need for a really expensive gym membership with a spa and other luxuries.

“In reality, just run in the great outdoors and use your own bodyweight for muscle building exercises that don’t cost a penny.

“But if you do want to go to the gym, then look at how to do this in a savvy way.

“Use the ‘bring a friend’ discount, which often works out to less than a £1 per workout.

“Or save up the money you’d use on a membership and buy exercise machines to use at home.”

Pernia initially saved £23, then a further £14 when bringing her workouts to home.

The accountant now uses her money-saving expertise to help others through her social media.

She also has a weekly newsletter, ebooks, courses and offers 1:1 calls to get people’s finances back on track.

Her other savings include rent, which she has brought down to an impressive £1,000.

Pernia did this simply by negotiating with her landlord, moving to a nearby area where house prices are cheaper, opting for a longer tenancy and paying a few months rent up front.

She added: “A lot of people’s ability to save all comes down to mindset.

“Can you avoid hype purchases and the latest tech for example?

“Everything nowadays is just a trend; don’t get swept up in it.

“You can still buy a coffee out and have avocado on toast without breaking the bank.

“It’s important to balance doing the things you enjoy with optimising your spending on them, rather than cutting out all the fun.”

SAVINGS BREAKDOWN:

Phone contract: £26 per month

Free Disney+ for six months: £8.99 per month

Rent: £1,000 per month

Utilities: £30 per month

Groceries and takeaways: £270 per month

Subscriptions: £84.94 per month

Gym: £37 per month

Total: £1,456.93 per month

Leave a Reply